Navigating the Labyrinth: A Complete Information to the US State Gross sales Tax Map

Associated Articles: Navigating the Labyrinth: A Complete Information to the US State Gross sales Tax Map

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Navigating the Labyrinth: A Complete Information to the US State Gross sales Tax Map. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Navigating the Labyrinth: A Complete Information to the US State Gross sales Tax Map

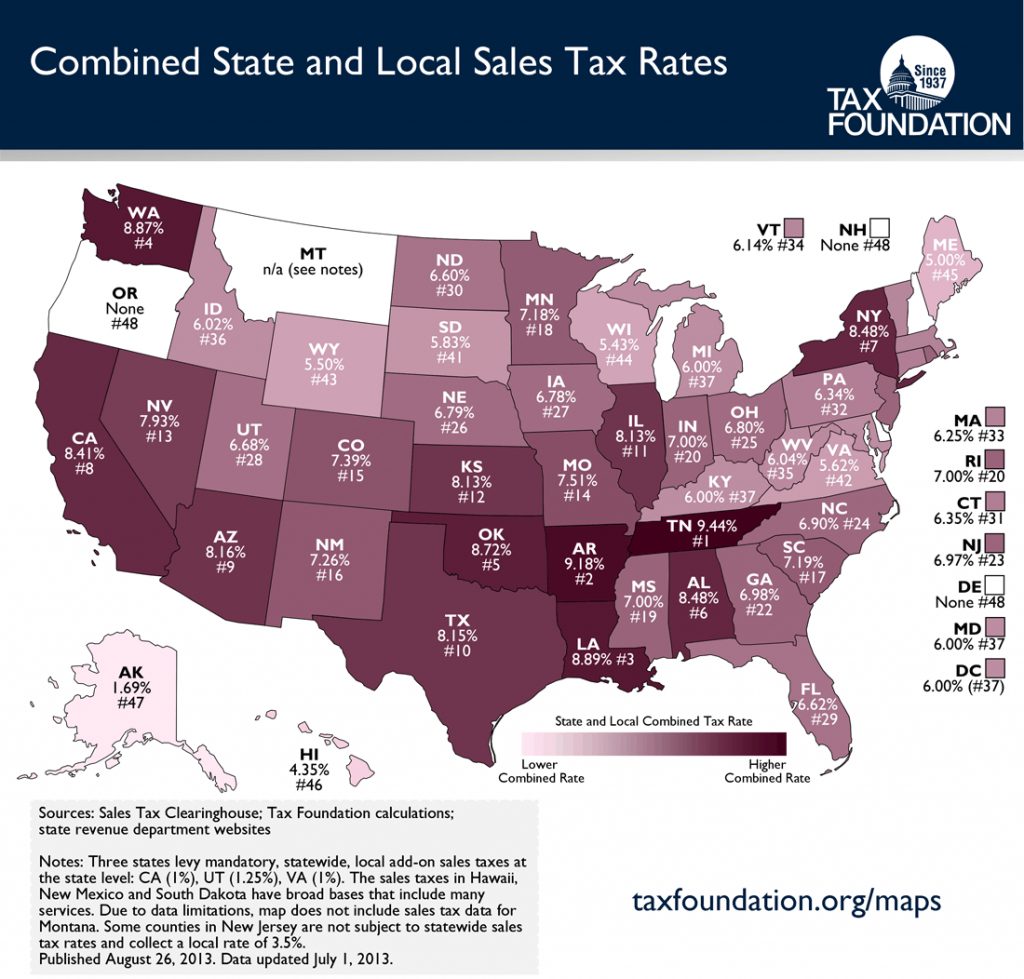

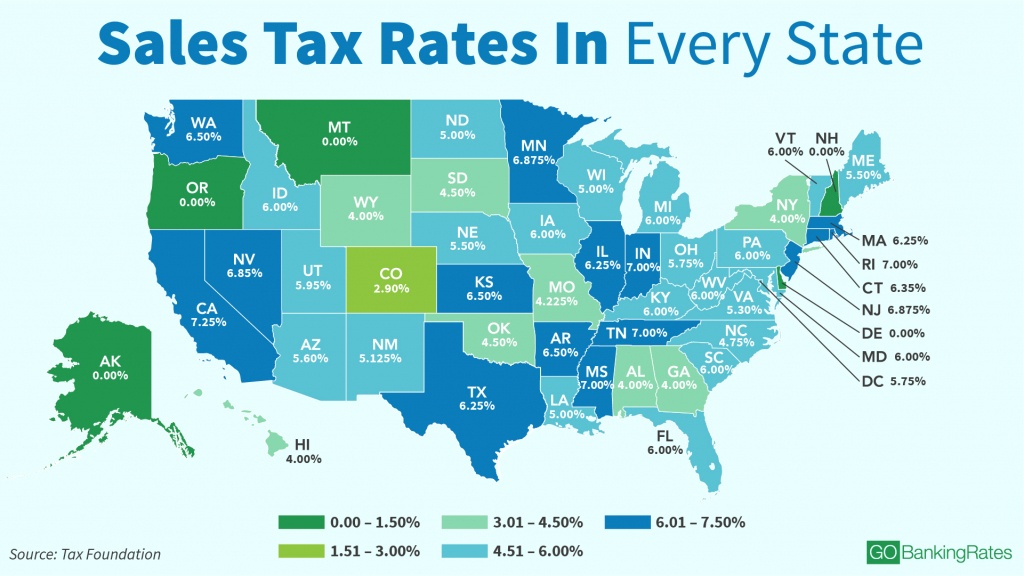

America boasts a posh and sometimes complicated system of state gross sales taxes. In contrast to a nationwide gross sales tax, every state (and even some cities and counties inside these states) units its personal charges, making a patchwork of various levies throughout the nation. Understanding this intricate panorama is essential for companies working throughout state strains, customers making on-line purchases, and anybody looking for to navigate the monetary implications of residing in, or touring to, completely different components of the nation. This text offers a complete overview of the US state gross sales tax map, delving into its nuances, regional variations, and the implications for each companies and people.

The Fundamentals: Understanding State Gross sales Tax

Gross sales tax is a consumption tax levied on the sale of products and, in some instances, providers. In contrast to revenue tax, which relies on earnings, gross sales tax is imposed on the transaction itself. The tax fee varies considerably from state to state, starting from 0% in some states to over 10% in others. This variability is a key attribute of the US gross sales tax system, contributing to its complexity.

The State-by-State Breakdown: A Geographic Overview

The absence of a federal gross sales tax necessitates a state-level method. Consequently, a gross sales tax "map" is not a easy visible illustration however a posh information set mirrored in varied on-line sources and tax publications. As an example the regional variations, we are able to broadly categorize states based mostly on their gross sales tax charges:

-

No Gross sales Tax States: 5 states presently don’t have any state gross sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon. Nonetheless, it is essential to notice that even in these states, native governments would possibly impose their very own gross sales taxes on particular items or providers.

-

Low Gross sales Tax States: A number of states boast comparatively low gross sales tax charges, typically under 5%. These typically appeal to companies and residents looking for to reduce tax burdens. Examples embody Wyoming, South Dakota, and Arkansas. Nonetheless, even in low-tax states, native taxes can add to the general value.

-

Excessive Gross sales Tax States: States with greater gross sales tax charges, typically exceeding 7%, are usually discovered within the Northeast and South. California, Louisiana, and Illinois are examples of states with comparatively excessive gross sales tax charges. Once more, native taxes can considerably improve the efficient fee.

-

Regional Traits: Observing regional traits in gross sales tax charges reveals attention-grabbing patterns. The South and Northeast are likely to have greater common charges, whereas the West and Midwest exhibit extra variability, with some states having low charges and others falling into the mid-range. These traits are influenced by a large number of things, together with state income wants, political priorities, and financial situations.

Past the State Degree: Native Taxes and Particular Districts

The complexity of the US gross sales tax system extends past the state stage. Many cities and counties impose their very own gross sales taxes, typically including a number of proportion factors to the state fee. These native taxes can considerably improve the full tax burden on customers, making it essential to know the particular tax fee relevant in a given location. Moreover, some particular districts, akin to transportation authorities or faculty districts, may levy extra gross sales taxes, additional complicating the image.

The Impression on Companies: Navigating the Multi-State Market

For companies working in a number of states, understanding the gross sales tax panorama is paramount. The need of gathering and remitting gross sales tax in every state the place they’ve a "nexus" – a bodily presence or financial exercise – creates vital administrative burdens. This contains:

-

Nexus Willpower: Figuring out the states the place a enterprise has nexus requires cautious evaluation of its operations, together with bodily places, stock storage, and on-line gross sales. Misinterpreting nexus guidelines can result in vital penalties.

-

Gross sales Tax Registration: Companies with nexus in a state are required to register with the state’s tax authority and acquire a gross sales tax allow. This includes finishing varied types and offering detailed details about the enterprise.

-

Tax Price Calculation and Remittance: Calculating and remitting gross sales taxes in a number of states requires meticulous record-keeping and correct tax fee willpower. Errors may end up in vital monetary penalties.

-

Streamlined Gross sales Tax (SST): The Streamlined Gross sales Tax undertaking goals to simplify the gross sales tax compliance course of for companies by harmonizing tax charges and procedures throughout taking part states. Whereas not universally adopted, it represents a big effort in direction of lowering the burden on companies.

The Impression on Shoppers: Understanding the Complete Price

Shoppers are straight impacted by state gross sales taxes, as they add to the general value of products and providers. Understanding the relevant tax fee is essential for budgeting and monetary planning. On-line buying additional complicates this, as customers could not at all times pay attention to the gross sales tax implications of buying from out-of-state distributors. The rise of e-commerce has introduced elevated scrutiny to the problem of gross sales tax assortment on on-line gross sales, resulting in ongoing authorized and regulatory developments.

The Way forward for State Gross sales Tax: Traits and Challenges

The US state gross sales tax system is continually evolving. A number of traits and challenges are shaping its future:

-

E-commerce and Gross sales Tax Assortment: The continued debate concerning gross sales tax assortment on on-line gross sales continues to be a big situation. The Supreme Courtroom’s determination in South Dakota v. Wayfair, Inc. (2018) considerably altered the panorama, permitting states to gather gross sales tax from out-of-state companies with out a bodily presence.

-

Tax Simplification Efforts: Ongoing efforts to simplify the gross sales tax system, such because the Streamlined Gross sales Tax undertaking, goal to cut back the executive burden on companies and improve transparency for customers.

-

Tax Price Volatility: Gross sales tax charges are topic to alter based mostly on state budgets and financial situations. Shoppers and companies want to stay vigilant about potential changes.

-

Technological Developments: Expertise is taking part in an more and more vital function in gross sales tax compliance, with software program options serving to companies automate tax calculations and filings.

Conclusion: A Fixed State of Flux

The US state gross sales tax map is a dynamic and complicated entity. Understanding its intricacies is crucial for each companies and customers. Staying knowledgeable about adjustments in tax charges, nexus guidelines, and compliance necessities is essential for navigating this multifaceted system. The continued evolution of the gross sales tax panorama necessitates steady vigilance and adaptation, highlighting the significance of dependable sources {and professional} steering when coping with state gross sales tax points. From the absence of tax in some states to the layered complexities of native levies, the US gross sales tax system presents a novel and continuously evolving problem within the American financial panorama.

.png)

Closure

Thus, we hope this text has offered helpful insights into Navigating the Labyrinth: A Complete Information to the US State Gross sales Tax Map. We respect your consideration to our article. See you in our subsequent article!