Decoding the Buying and selling Map: A Complete Information to Navigating Market Landscapes

Associated Articles: Decoding the Buying and selling Map: A Complete Information to Navigating Market Landscapes

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Buying and selling Map: A Complete Information to Navigating Market Landscapes. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the Buying and selling Map: A Complete Information to Navigating Market Landscapes

The monetary markets are sometimes described as a fancy and unpredictable panorama. Whereas that is partially true, the obvious chaos will be considerably mitigated by understanding and successfully using a "buying and selling map." This is not a literal map, however a metaphorical illustration of the knowledge and instruments merchants use to navigate the market’s terrain, determine alternatives, and handle danger. This complete information explores the important thing parts of a strong buying and selling map, encompassing technical evaluation, elementary evaluation, danger administration, and psychological preparedness.

I. The Basis: Charting and Technical Evaluation

The bedrock of any buying and selling map is technical evaluation. This entails finding out historic value motion and quantity knowledge to determine patterns, tendencies, and potential future value actions. Key parts embrace:

-

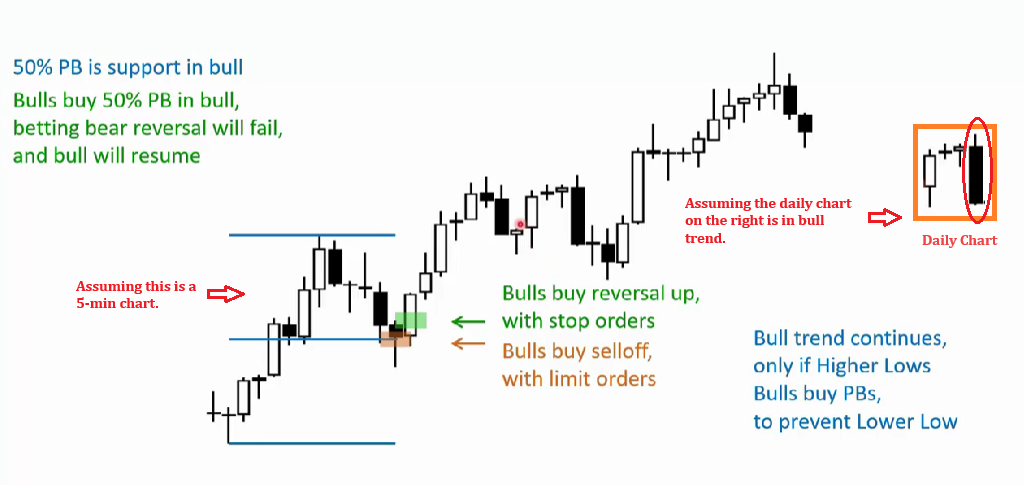

Value Charts: Completely different chart varieties – candlestick, bar, line – provide distinctive views on value fluctuations. Candlestick charts, for instance, visually symbolize the opening, closing, excessive, and low costs of an asset over a particular interval, providing insights into market sentiment and momentum.

-

Technical Indicators: These are mathematical calculations utilized to cost and quantity knowledge, designed to spotlight particular market circumstances. Well-liked indicators embrace:

- Transferring Averages (MA): Clean out value fluctuations, figuring out tendencies and potential help/resistance ranges. Easy Transferring Averages (SMA) and Exponential Transferring Averages (EMA) are generally used.

- Relative Power Index (RSI): Measures the magnitude of latest value adjustments to judge overbought or oversold circumstances.

- Transferring Common Convergence Divergence (MACD): Identifies adjustments in momentum by evaluating two transferring averages.

- Bollinger Bands: Present value volatility and potential reversal factors.

- Fibonacci Retracements: Based mostly on the Fibonacci sequence, these determine potential help and resistance ranges throughout value corrections.

-

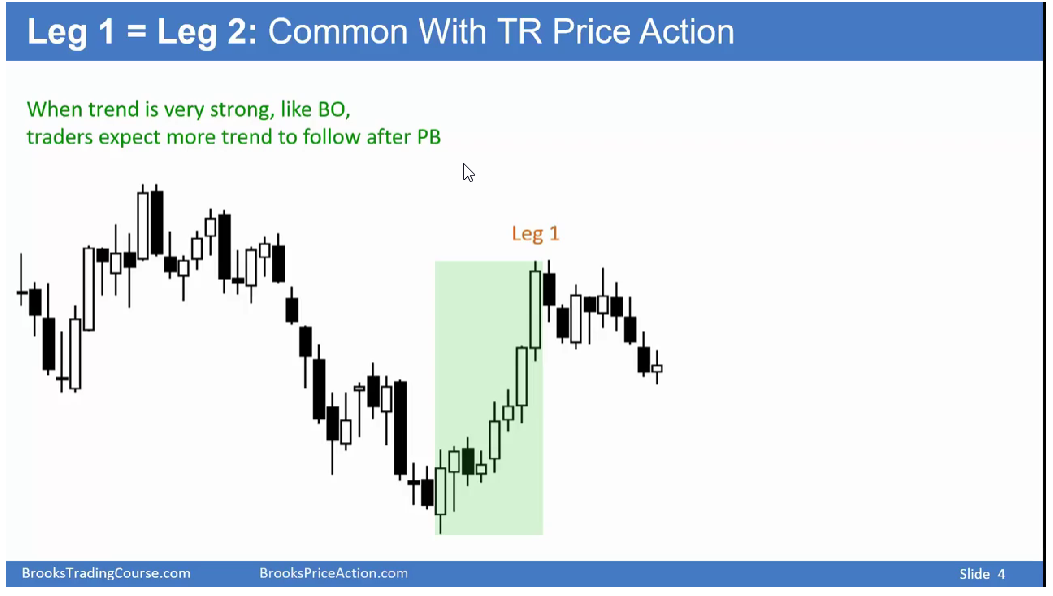

Chart Patterns: Recurring value formations that may predict future value actions. Widespread patterns embrace head and shoulders, double tops/bottoms, triangles, flags, and pennants. Recognizing these patterns enhances predictive capabilities.

-

Assist and Resistance Ranges: Value ranges the place shopping for or promoting strain is especially robust, usually performing as obstacles to cost motion. Breaks above resistance or beneath help can sign vital shifts in momentum.

II. Laying the Groundwork: Basic Evaluation

Whereas technical evaluation focuses on value motion, elementary evaluation delves into the underlying components that affect an asset’s worth. That is essential for long-term funding methods and for understanding the broader financial context affecting market tendencies. Key parts embrace:

-

Firm Financials (for shares): Inspecting monetary statements like revenue statements, steadiness sheets, and money circulation statements to evaluate an organization’s profitability, solvency, and development potential. Metrics like earnings per share (EPS), price-to-earnings ratio (P/E), and debt-to-equity ratio are essential.

-

Financial Indicators (for all property): Monitoring macroeconomic knowledge like inflation charges, rates of interest, GDP development, unemployment figures, and shopper confidence indices to gauge the general well being of the financial system and its affect on asset costs.

-

Business Evaluation: Understanding the aggressive panorama, regulatory surroundings, and technological developments inside a particular business to evaluate the prospects of firms working inside that sector.

-

Geopolitical Occasions: Main world occasions, political instability, and worldwide relations can considerably affect market sentiment and asset costs.

III. Navigating the Terrain: Threat Administration

A vital side of any buying and selling map is danger administration. This entails methods to restrict potential losses and defend capital. Important parts embrace:

-

Place Sizing: Figuring out the suitable quantity of capital to allocate to every commerce, limiting potential losses to a manageable share of the general buying and selling account.

-

Cease-Loss Orders: Pre-set orders that routinely promote an asset when it reaches a specified value, limiting potential losses.

-

Take-Revenue Orders: Pre-set orders that routinely promote an asset when it reaches a specified value, securing earnings.

-

Diversification: Spreading investments throughout completely different property to scale back the affect of losses in any single asset.

-

Backtesting: Testing buying and selling methods on historic knowledge to judge their effectiveness and determine potential weaknesses.

IV. The Compass: Psychological Preparedness

Profitable buying and selling is not solely about technical and elementary evaluation; it additionally requires robust psychological self-discipline. This consists of:

-

Emotional Management: Avoiding impulsive choices pushed by concern or greed. Sticking to a well-defined buying and selling plan is essential.

-

Self-discipline: Adhering to the established buying and selling plan and danger administration guidelines, even in periods of market volatility.

-

Persistence: Understanding that worthwhile buying and selling takes effort and time. Avoiding chasing fast earnings and permitting trades to play out in response to the plan.

-

Steady Studying: Staying up to date on market tendencies, information, and creating new buying and selling abilities by schooling and expertise.

-

Self-Reflection: Commonly reviewing buying and selling efficiency, figuring out areas for enchancment, and adapting the buying and selling technique accordingly.

V. Integrating the Parts: Constructing Your Buying and selling Map

Constructing a complete buying and selling map requires integrating all the weather mentioned above. This entails:

-

Defining your buying and selling type: Are you a day dealer, swing dealer, or long-term investor? Your buying and selling type will dictate the timeframe you deal with and the symptoms you make the most of.

-

Selecting your markets: Which asset lessons will you commerce – shares, foreign exchange, cryptocurrencies, commodities? Every market has its personal distinctive traits and requires particular data.

-

Creating your buying and selling plan: This could define your entry and exit methods, danger administration guidelines, and psychological method.

-

Backtesting your technique: Testing your plan on historic knowledge to determine potential flaws and refine your method.

-

Monitoring and adapting: Repeatedly monitoring market circumstances and adapting your technique primarily based on new info and altering circumstances.

VI. Past the Map: The Significance of Steady Studying

The monetary markets are always evolving. A static buying and selling map will shortly turn out to be out of date. Steady studying is paramount for long-term success. This consists of staying up to date on market information, studying monetary publications, attending webinars, and interesting with different merchants. The pursuit of information is an ongoing journey, not a vacation spot.

In conclusion, a profitable buying and selling map is a dynamic software that evolves with expertise and market adjustments. It integrates technical and elementary evaluation, strong danger administration, and unwavering psychological self-discipline. By understanding and successfully using these parts, merchants can navigate the complexities of the monetary markets with elevated confidence and enhance their possibilities of attaining their monetary objectives. Bear in mind, the map shouldn’t be the territory; it is a information that will help you discover and perceive the ever-changing panorama of the markets.

Closure

Thus, we hope this text has supplied useful insights into Decoding the Buying and selling Map: A Complete Information to Navigating Market Landscapes. We recognize your consideration to our article. See you in our subsequent article!