Decoding Madison County’s Tax Map: A Complete Information

Associated Articles: Decoding Madison County’s Tax Map: A Complete Information

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Decoding Madison County’s Tax Map: A Complete Information. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding Madison County’s Tax Map: A Complete Information

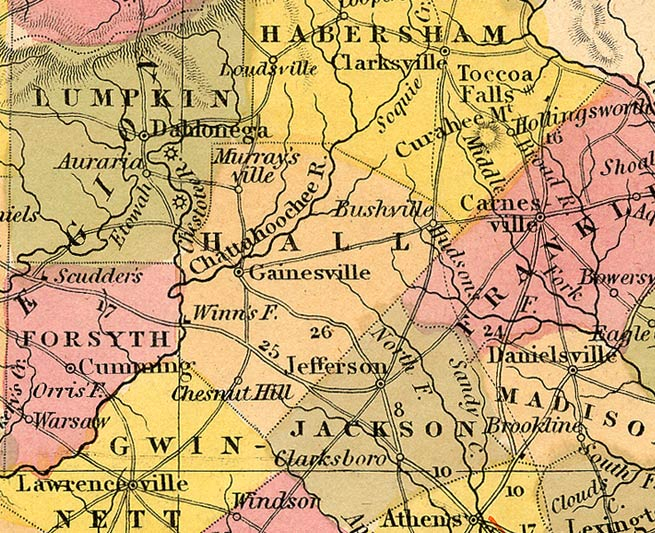

Madison County, like another county throughout the nation, depends on property taxes as an important income for important public providers. Understanding the county’s tax map is due to this fact important for property house owners, potential consumers, traders, and anybody within the county’s fiscal well being and actual property panorama. This text delves into the intricacies of Madison County’s tax map (assuming a generic Madison County; specifics will differ by state), explaining its objective, accessibility, interpretation, and the data it offers. We’ll additionally discover potential makes use of and limitations of the map.

The Goal of the Madison County Tax Map

The first objective of the Madison County tax map is to supply a visible illustration of all taxable properties throughout the county’s boundaries. This detailed map serves a number of crucial capabilities:

-

Property Evaluation: The map types the idea for property assessments. Every parcel of land is uniquely recognized and its traits (dimension, enhancements, location) are recorded, permitting assessors to find out its honest market worth for taxation functions.

-

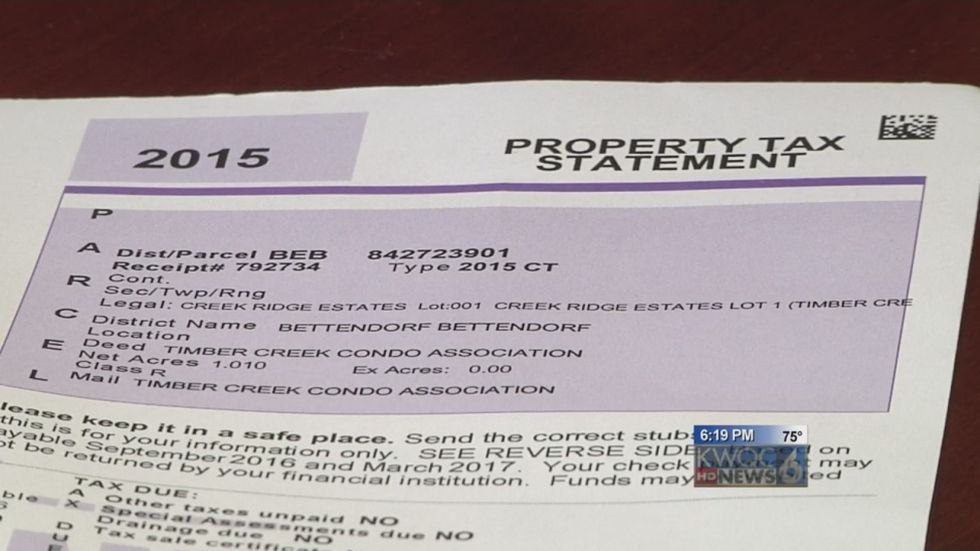

Tax Billing: The map is integral to the tax billing course of. Every parcel’s distinctive identifier hyperlinks it to the corresponding tax document, guaranteeing correct billing and assortment.

-

Property Document Conserving: The map acts as a central repository for property info, simplifying the administration and monitoring of possession, assessments, and tax funds.

-

Planning and Growth: The map is a invaluable software for city planners, builders, and different stakeholders concerned in land use planning and growth initiatives. It offers essential details about property boundaries, zoning laws, and present infrastructure.

-

Emergency Providers: Emergency responders can make the most of the tax map to rapidly find properties throughout emergencies, bettering response instances and effectivity.

-

Public Entry to Info: The map offers transparency to the general public, permitting anybody to entry details about property possession, assessments, and tax liabilities. This transparency promotes accountability and facilitates knowledgeable decision-making.

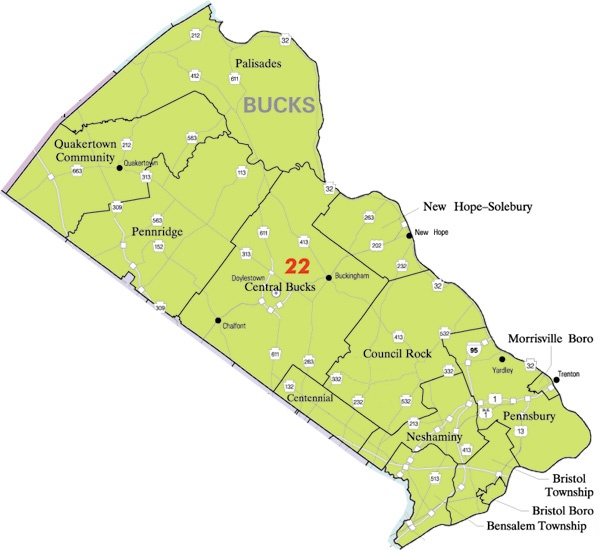

Accessing the Madison County Tax Map

Entry to the Madison County tax map usually varies relying on the precise county and state. Nevertheless, most counties provide on-line entry by their official web sites. The strategies of entry would possibly embrace:

-

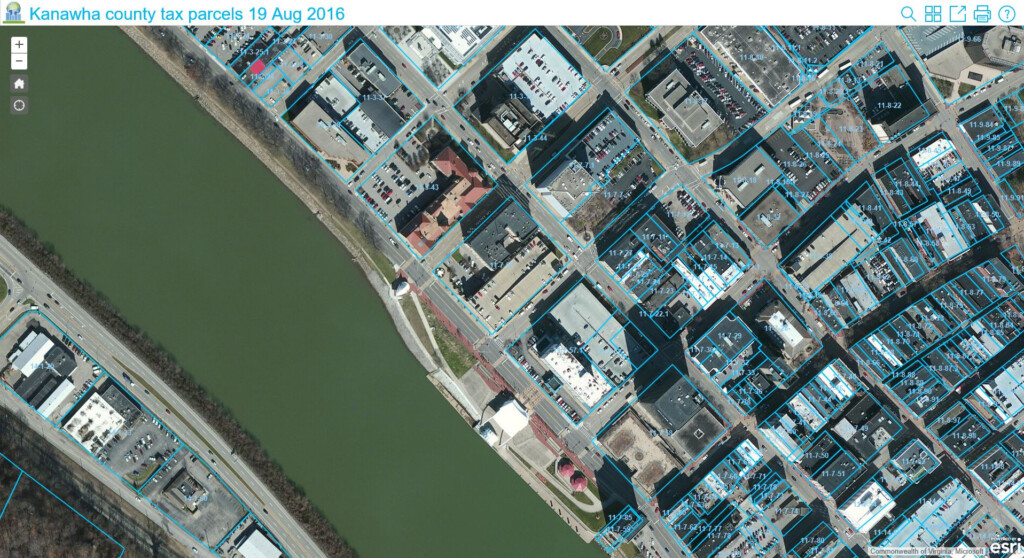

On-line GIS (Geographic Info System): Many counties make the most of refined GIS programs that permit customers to seek for properties by handle, parcel quantity, or proprietor title. These programs usually present interactive maps with zoom capabilities, permitting for detailed exploration.

-

Searchable Database: Some counties could provide a searchable database that hyperlinks property info to the tax map. This permits customers to seek out particular properties and look at their related tax info.

-

Bodily Copies: Whereas much less widespread as a result of prevalence of on-line entry, bodily copies of the tax map could also be out there on the county assessor’s workplace or different related authorities buildings.

-

Third-Social gathering Web sites: A number of third-party web sites combination property knowledge from numerous counties, together with tax map info. Nevertheless, it is essential to confirm the accuracy and reliability of data obtained from these sources.

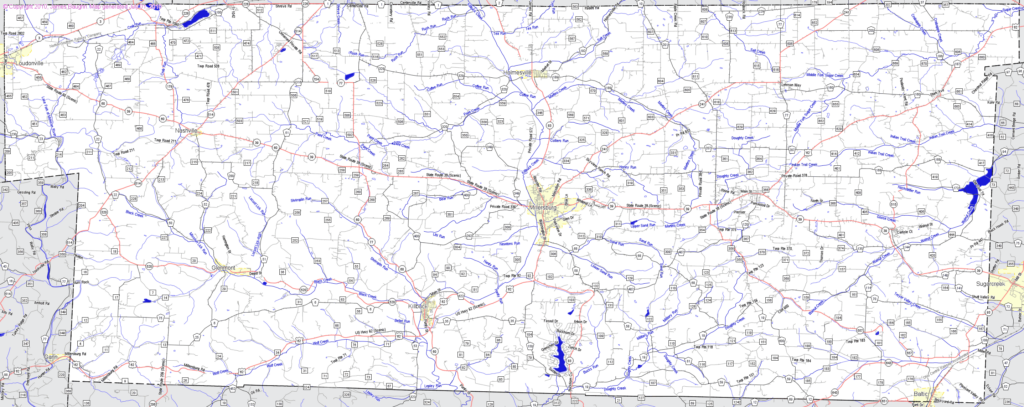

Decoding the Madison County Tax Map

Madison County’s tax map will seemingly incorporate numerous symbols, colours, and notations to convey several types of info. Key components to know embrace:

-

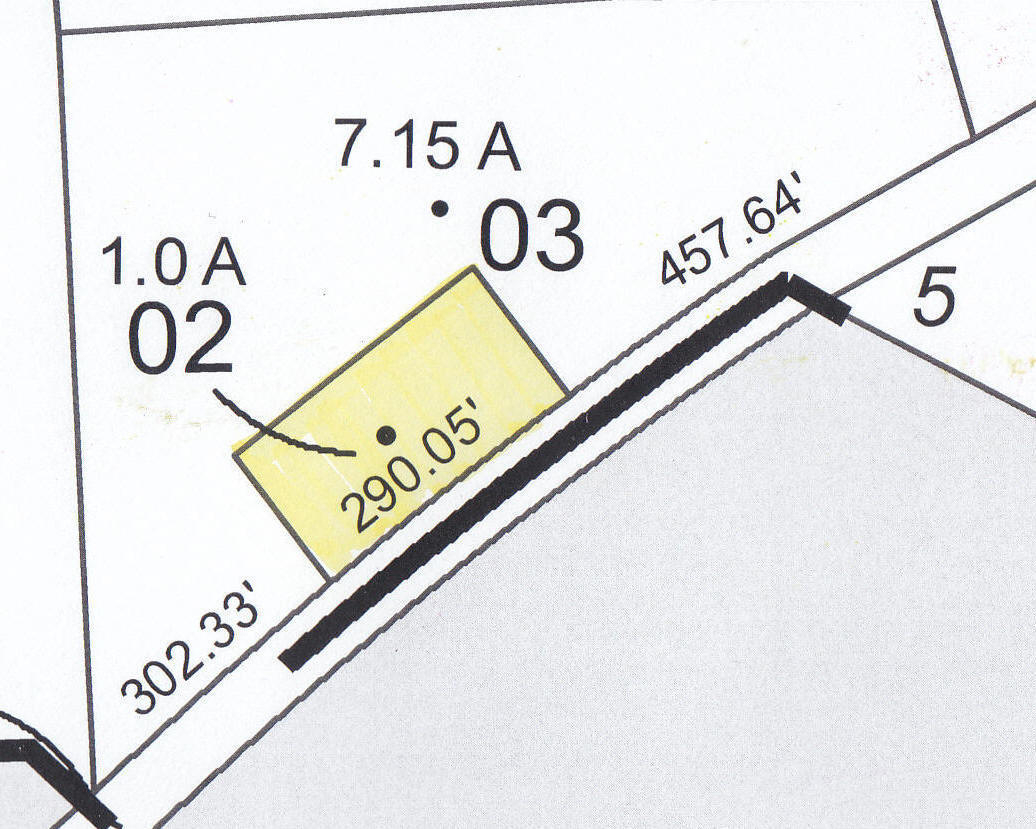

Parcel Boundaries: These are the strains defining the bounds of every particular person property. They’re essential for figuring out property dimension and possession.

-

Parcel Numbers: Every parcel is assigned a novel identification quantity, important for monitoring and accessing particular property info.

-

Property Addresses: Addresses are usually proven on the map, facilitating simple location of properties.

-

Land Use Codes: These codes point out the kind of land use for every parcel (e.g., residential, business, agricultural).

-

Zoning Info: The map could point out zoning classifications, exhibiting permitted land makes use of in several areas.

-

Enhancements: Constructions similar to buildings, roads, and different infrastructure are sometimes depicted on the map.

-

Proper-of-Methods: Public easements and right-of-ways are usually indicated, exhibiting areas the place the general public has entry.

-

Water Options: Rivers, lakes, and different water our bodies are normally proven, offering context to property location.

Info Offered by the Map

The Madison County tax map offers a wealth of data past easy property boundaries. This contains:

-

Possession Info: The map usually hyperlinks to databases containing proprietor names and speak to info.

-

Evaluation Particulars: The assessed worth of the property, used for tax calculation, is normally accessible by the map’s linked databases.

-

Tax Info: Property tax charges and quantities due are usually accessible by the map’s related data.

-

Authorized Descriptions: Exact authorized descriptions of property boundaries are sometimes out there, offering detailed info for authorized and surveying functions.

-

Topographical Options: Elevation modifications and different topographical options could also be represented on the map, notably in areas with important terrain variations.

Makes use of of the Madison County Tax Map

The Madison County tax map is a flexible software with quite a few purposes:

-

Actual Property Transactions: Patrons and sellers use the map to confirm property boundaries, assess property dimension, and perceive surrounding land use.

-

Property Funding: Buyers make the most of the map to establish potential funding alternatives, assess property values, and analyze market traits.

-

Land Growth Planning: Builders use the map to plan new development initiatives, guaranteeing compliance with zoning laws and understanding present infrastructure.

-

Environmental Research: The map can be utilized in environmental influence assessments, offering info on land use patterns and potential environmental sensitivities.

-

Analysis and Evaluation: Researchers can use the map to investigate land use modifications over time, assess the influence of growth, and research numerous geographical patterns.

Limitations of the Madison County Tax Map

Whereas the tax map is a invaluable useful resource, it is vital to acknowledge its limitations:

-

Accuracy: Whereas usually correct, maps can include errors or omissions. It is essential to confirm info with official data.

-

Scale: The size of the map could restrict the element seen, particularly for smaller parcels or intricate options.

-

Updates: Maps are periodically up to date, however there may be a time lag between modifications on the bottom and their reflection on the map.

-

Interpretation: Decoding map symbols and notations requires understanding of cartographic conventions.

-

Knowledge Completeness: Not all info associated to a property may be included on the map or its linked databases.

Conclusion

The Madison County tax map serves as a cornerstone of property administration, planning, and public info. Understanding its objective, entry strategies, interpretation, and limitations is essential for anybody coping with property in Madison County. By leveraging the data offered by this invaluable useful resource, people and organizations could make knowledgeable selections, promote transparency, and contribute to the efficient governance of the county. Keep in mind to at all times confirm info obtained from the tax map with official sources to make sure accuracy and reliability. The precise options and functionalities of the Madison County tax map will differ relying on the precise county and state, so it is at all times advisable to seek the advice of the official county web site for essentially the most up-to-date and correct info.

Closure

Thus, we hope this text has offered invaluable insights into Decoding Madison County’s Tax Map: A Complete Information. We respect your consideration to our article. See you in our subsequent article!